venmo tax reporting for personal use 2022

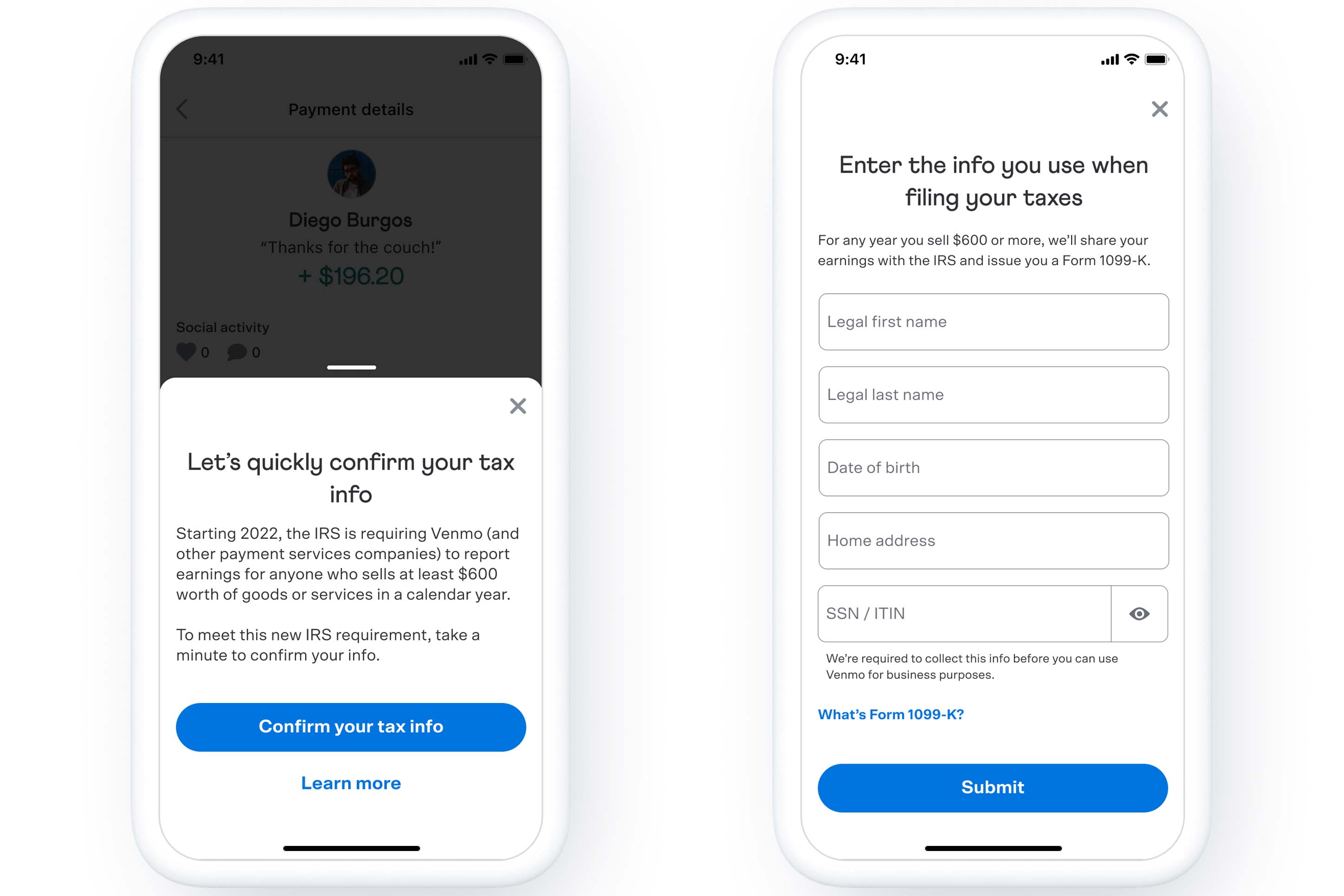

The tax code allows you to deduct certain costs of doing business from gross income. To help ensure that you can continue collecting and accessing payments for goods and services on Venmo once the threshold lowers were asking individuals who havent.

Advice On Venmo Having To Submit Sums Over 600 To The Irs R Personalfinance

A business transaction is defined as payment for a good or service.

. That means the first 1099-Ks issued under the new lower. 20000 or more in payments annually. But users were largely mistaken to believe the change applied to them.

Previously the IRS only required businesses to report transactions if they received. If you receive 600 or more payments for goods and services through a third-party payment network such as Venmo or CashApp these payments will now be reported to the IRS. This new tax rule only applies to payments for goods and services not for personal payments between friends and family.

The IRS is not requiring individuals to report or pay taxes on individual Venmo Cash App or PayPal transactions over 600. As of Jan. How Do You Know If Youre Eligible To Receive Form 1099-K from Venmo.

If you meet the conditions set by the IRS then the platform will request you to confirm your US taxpayer status. This new tax rule only applies to payments for goods and services not for personal payments between friends and family. The new requirement -- included in the American Rescue Plan which was signed into law last year -- will apply to tax year 2022 and beyond.

The reporting form to use is a Form 1099-K. If this number was met the payment app was. If youre making money via payment apps start keeping records now.

Changes to Tax Laws for Venmo and PayPal. Get Ready to Pay Taxes on Money Earned Through Paypal and Venmo Next Year Earnings over 600 will be reported to the IRS. Beginning with tax year 2022 if someone receives payment for goods and services through a third- party payment network their income will be reported on Form 1099-K if 600 or more was processed as opposed to the current Form 1099-K reporting requirement of 200.

Those posts refer to a provision in the American Rescue Plan Act which went into effect on January 1 2022 according to which anyone receiving 600 per year using Venmo PayPal Zelle or Cash App will receive a 1099-K and be required to report that income on their taxes. We know it can be concerning to receive a notice asking for your personal information but Venmo does need to confirm your tax info. This new tax rule only applies to payments for goods and services not for personal.

Social media posts like this one on Facebook understood the General Explanations of the Administrations Fiscal. Recent changes have lowered the reporting threshold for reporting payments made through third-party payment service providers including P2P apps. For example a taxpayer who uses their car for business may qualify to claim the standard mileage rate which is 56 cents per mile for 2021.

Before 2022 the minimum threshold for reporting business transactions in a tax year was 20000 in gross payments and more than 200 transactions. Under this new tax rule starting with the 2022 calendar year payment app providers will have to start reporting to the IRS a users business transactions if in aggregate they total 600 or more for the year. These payments may be made through.

The American Rescue Plan Act lowered the threshold for reporting P2P network transactions to 600. What is a Form 1099-K. The new reporting requirement only applies to sellers of goods and services not.

So if your business received 600 or more on Venmo PayPal or another P2P app those payments will be reported to the IRS and youll be held accountable for paying taxes on them. Payment app providers will. The change begins with transactions starting January 2022 so it doesnt impact 2021 taxes.

Government passed legislation for 2022 as part of the American Rescue Plan Act that forces online payment platforms like Venmo PayPal Stripe and Square to report all aggregate business payments of 600 or more to the IRS through a 1099-K form. The new tax reporting requirement will impact your 2022 tax return filed in 2023 Payments of 600 or more for goods and services through a third-party payment network such. Business owners using sites like PayPal or Venmo now face a stricter tax-reporting minimum of 600 a year.

The change will take effect during the 2022 tax season and is estimated to gross billions in tax funds. For the 2022 tax year the IRS is lowering the federal reporting threshold. Anyone who receives at least 600 in payments for goods and services through Venmo or any other payment app can expect to receive a Form 1099-K.

But Venmo tax reporting laws have changed and this change applies to all other P2P apps too. Claims suggest that the IRS changed the rules for Venmo in 2022. Starting the 2022 tax year the IRS will require reporting of payment transactions for goods and services sold that meets or exceeds 600 in a calendar year.

But it also sought to improve tax compliance by lowering to 600 the threshold for income reporting by third-party settlement organizations The. PayPal and Venmo will be required to provide customers with a 1099-K form if they receive 600 or more in goods and services transactions during the 2022 tax year. Previously the threshold was 20000 in income and 200 or more.

This means you will need to take into account the Threshold Change with your Tax Year 2022 filings. 1 mobile payment apps like Venmo PayPal and Cash App are required to report commercial transactions totaling more than 600 per. The IRS is not requiring individuals to report or pay taxes on individual Venmo Cash App or PayPal transactions over 600.

While Venmo is required to send this form to qualifying users its worth. Generally you cannot deduct personal living or family expensesBeginning with tax year 2022 if someone receives payment for goods and services. A Venmo user can send you a maximum of 299999 USD in a single transaction and a weekly maximum of 699999 USD.

The 1099-K change took effect January 1 2022.

New 2022 Tax Law For Etsy Payments Venmo Paypal More Made Urban

Taxes What To Know About Irs Changes For Payment Apps Like Venmo Paypal

/Venmo-ItsBusinessModelandCompetition2-7a04c392fba04909b3d5dd560a9782e3.png)

Venmo Its Business Model And Competition

New Venmo Paypal Tax Reporting Rules What You Need To Know Hourly Inc

Venmo Zelle Others Will Report Goods And Services Payments Of 600 Or More To Irs For 2022 Taxes R Tax

Tax Code Change Affects Mobile Payment App The Hawk Newspaper

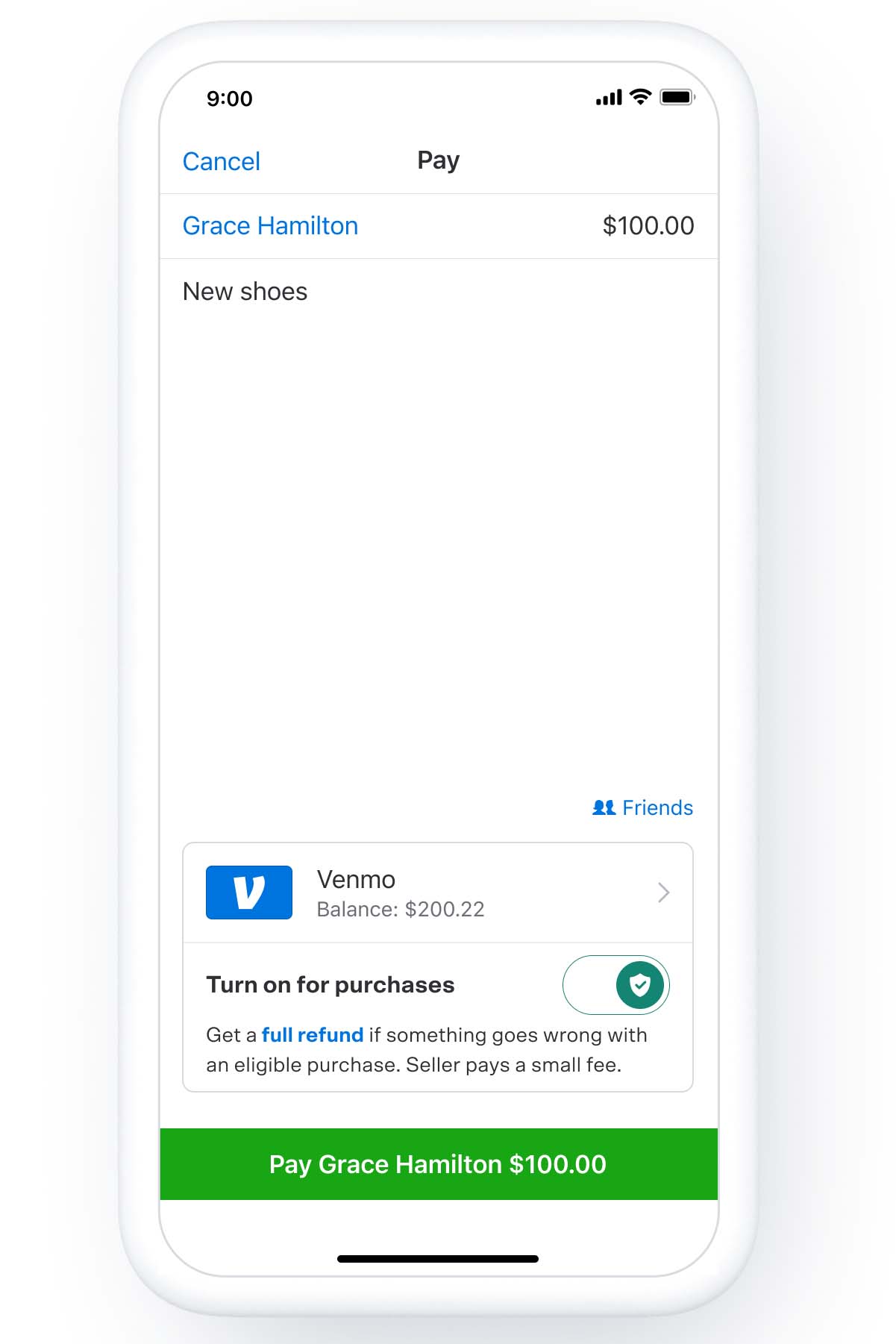

Press Release How To Confirm Your Tax Information To Accept Goods Services Payments On Venmo In 2022

Afraid The Irs Will Tax Your Venmo Paypal Or Other Payment App Transactions Here S What You Should Do The Washington Post

What To Know About The Irs New Reporting Requirements For Venmo Paypal And Other Payment Apps

Press Release How To Confirm Your Tax Information To Accept Goods Services Payments On Venmo In 2022

Irs Venmo Income Are Venmo Payments Considered Income Marca

If You Use Venmo Paypal Or Other Payment Apps This Tax Change May Affect You In 2022

Here S Who Will Have To Pay Taxes On Venmo Paypal Transactions Youtube

What To Know About Venmo And Your Taxes In 2022

Here Are The Tax Changes Coming To Venmo Cash App Paypal And Other Apps Forbes Advisor

Venmo Paypal And Zelle New Tax Reporting Rules

The Taxman Cometh The Irs Wants In On Your Venmo

Venmo Paypal And Zelle Must Report 600 In Transactions To Irs

:max_bytes(150000):strip_icc()/how-safe-venmo-and-why-it-free_FINAL-d6b7c0672d534208a05d1d53ae0cd915.png)